Standard Chartered Fixed Deposit

- Standard Chartered Online Banking

- Standard Chartered Fixed Deposit Interest Rates

- Standard Chartered Fixed Deposit Calculator

FAQ related to Standard Chartered Bank RD Interest Rate Calculator

(1) Can I deposit different monthly installments in RD account?

Standard Chartered Bank offers various term deposit options where clients can park their surplus savings for a fixed period of time. This form of deposit is a preferred investment route among people seeking attractive returns and high safety. Time Deposits (Fixed Deposits) Sustainable Time Deposit Time to invest in a sustainable future and earn up to 0.40% p.a. Singapore Dollar Time Deposit Earn up to 0.50% p.a. Interest with minimum S$25,000 placement sum.

Answer: No, you cannot deposit different monthly installments in a regular RD account. However, some banks offer Flexi RD which allows customers can deposit any amount at any point in the tenure with no requirement to make deposits every month.

(2) Will TDS be made on RD interest?

Answer: If the interest earned on RD is upto Rs 10,000, no TDS will be made. If it exceed the limit of Rs 10,000 then a TDS at 10% will be made. If your income is non-taxable, then you can submit Form 15G (for non-senior citizen)/ Form 15H (for senior citizen) in order to avoid deduction of TDS.

Standard Chartered Online Banking

(3) What is the duration of RD account?

Answer: Usually banks offer RDs of the duration from 6 months to 120 months (10 years). Some of the banks offer RD of 240 months also.

(4) Is there any maximum limit on RD amount that I want to deposit every month?

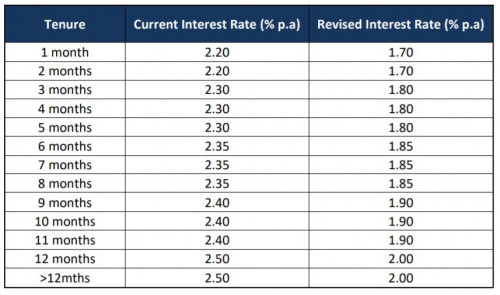

Standard Chartered Fixed Deposit Interest Rates

Answer: No, there is no upper cap on RD amount that you want to deposit every month. You can choose any amount according to your financial goals and objective as well as availability of funds.

(5) How the maturity value of Rd is calculated in the calculator?

Answer: The maturity value is calculated taking into account the deposit amount (monthly instalment), tenure and interest rate on RD. It uses compounding of interest formula. Frequency of compounding that the banks offer is quarterly.

(6) How much tax do I need to pay on interest earned on RD?

Standard Chartered Fixed Deposit Calculator

Answer: Tax to be paid by you solely depends upon the tax slab under which you come. It varies from person to person. Persons whose total income (inclusive of RD interest income) is non-taxable need not pay any income tax on RD interest.